Can’t resist a deal? The emotional and financial fallout of seasonal shopping sprees

Casinos Analyzer surveyed over 1,500 shoppers to understand the emotional and financial fallout of summer sales shopping, and why a good deal often comes with a hidden cost.

Key insights:

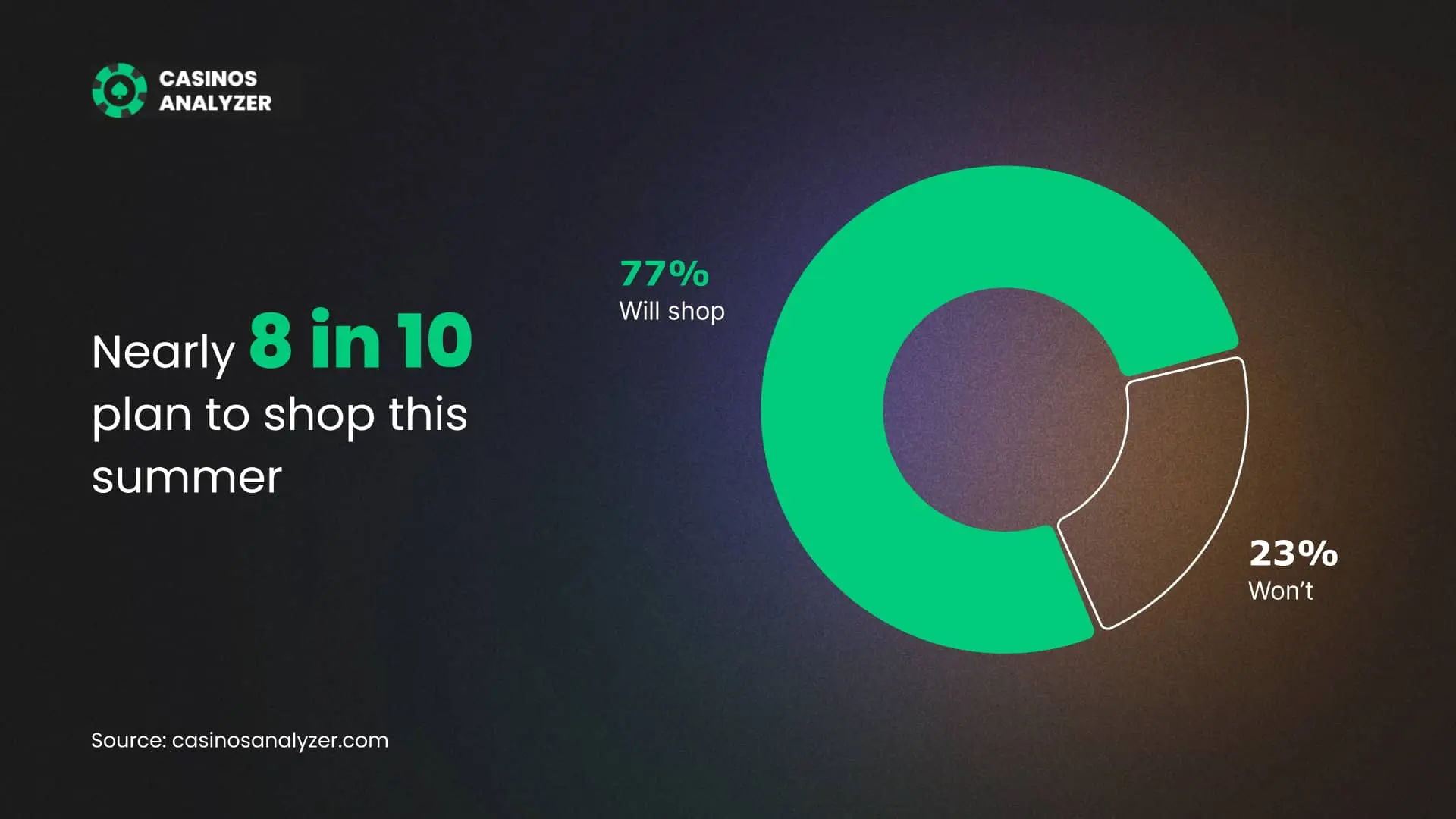

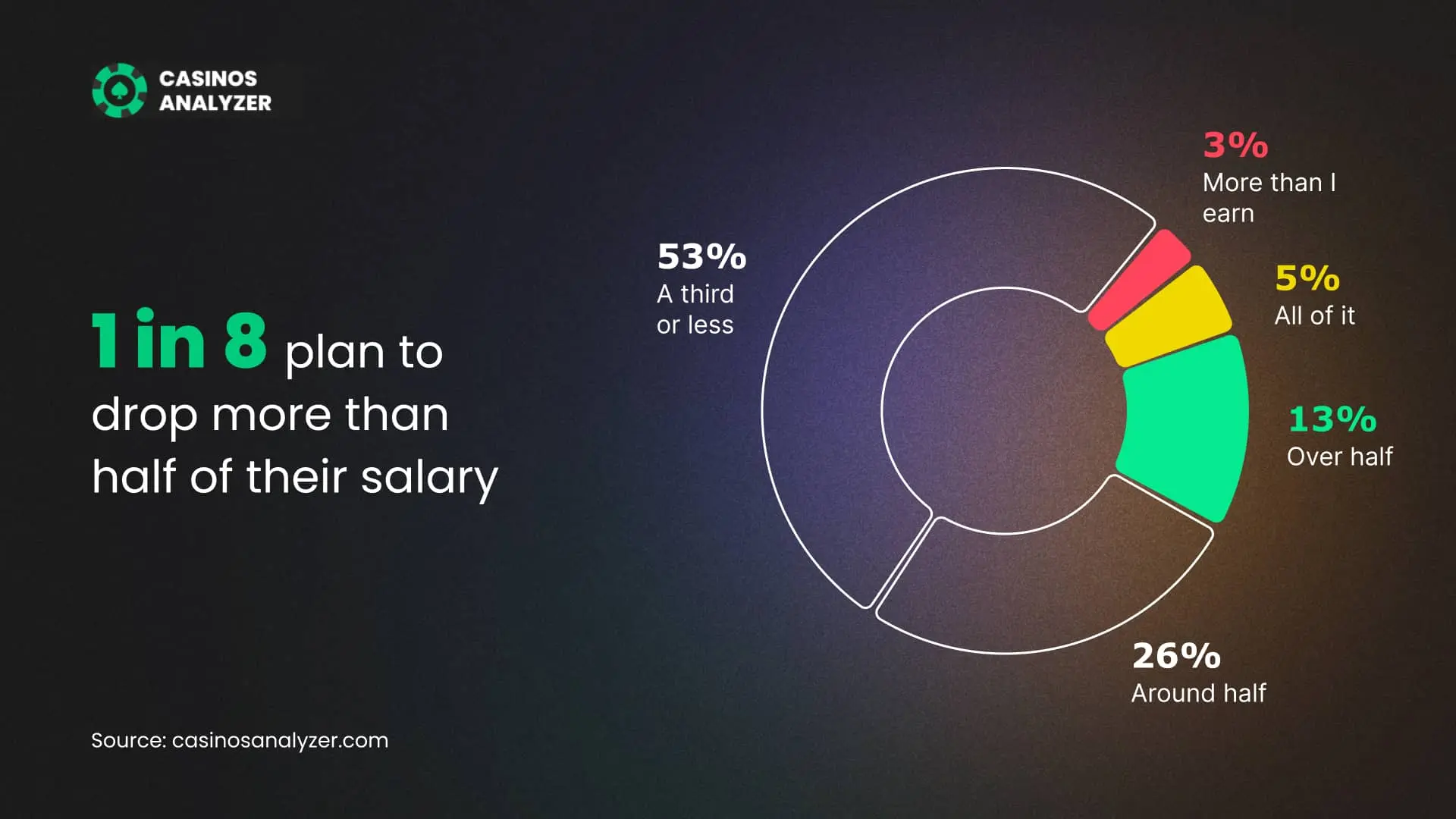

- A staggering 77% plan to shop during the summer sales – and many are prepared to go all in, with nearly 1 in 8 saying they’ll spend more than half their monthly salary

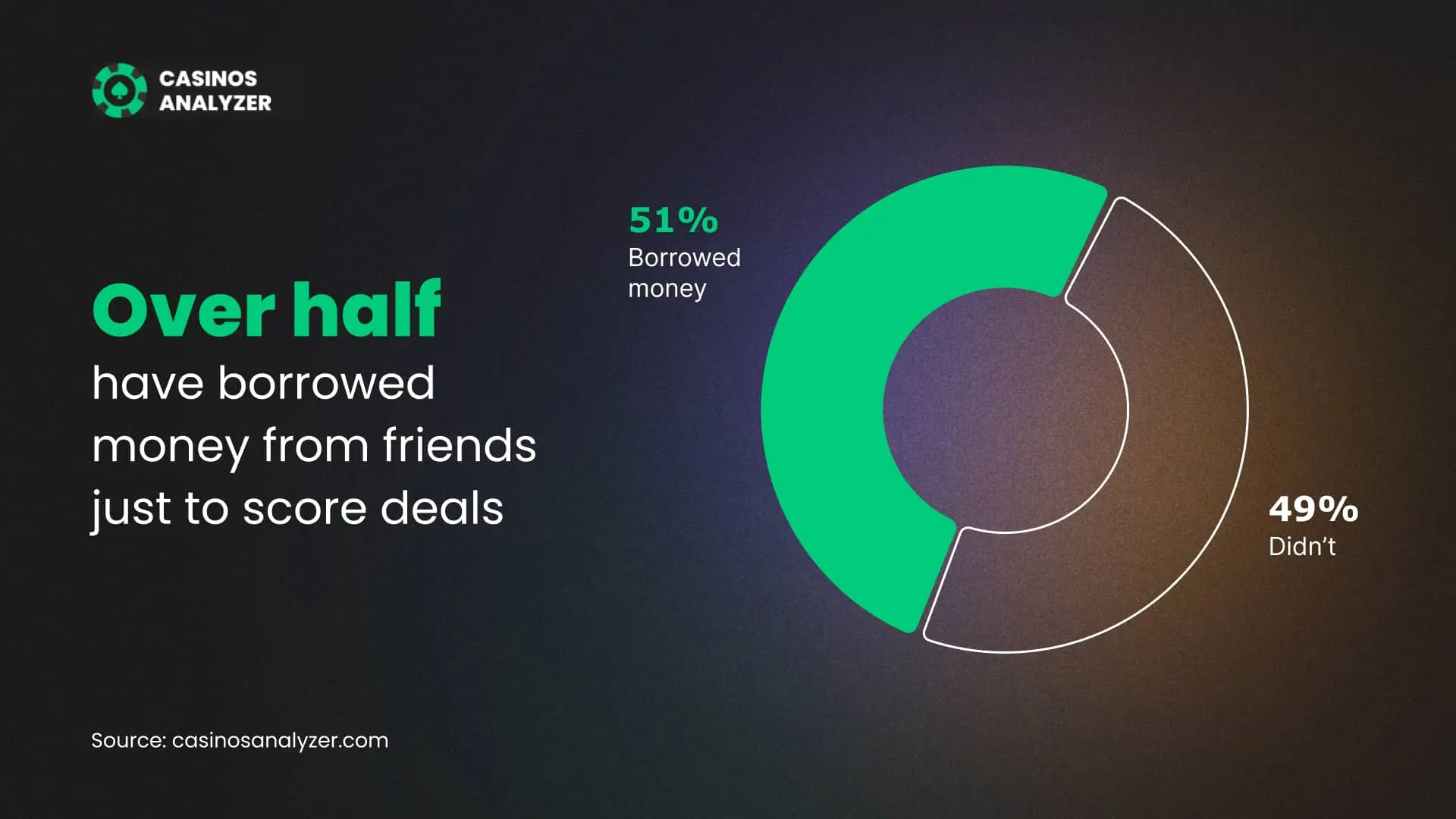

- 49% say they’ve been unable to afford food after a shopping spree, and over half (51%) have borrowed money from friends just to snag deals

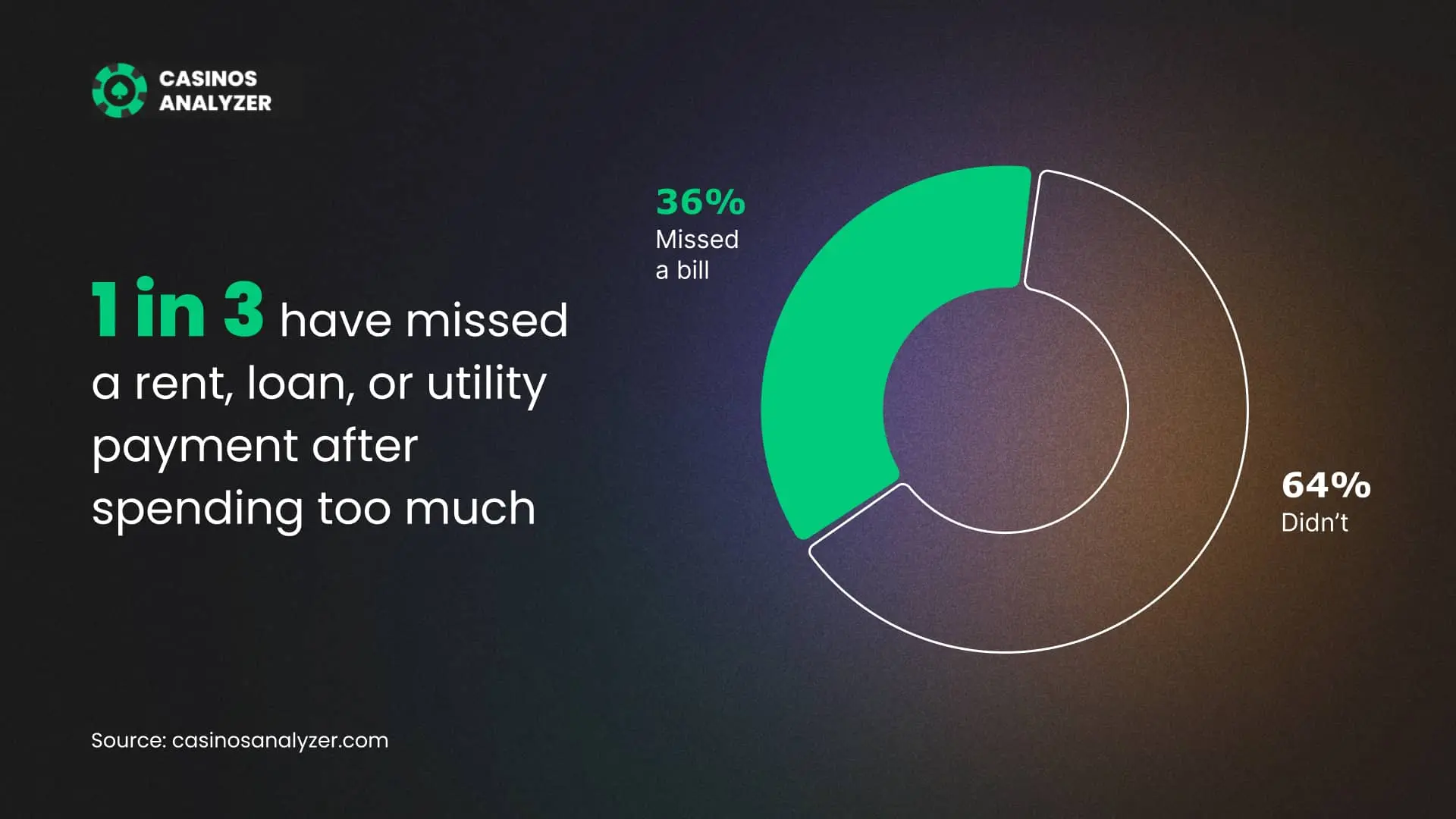

- One in three has missed a rent, utility, or loan payment because of overspending

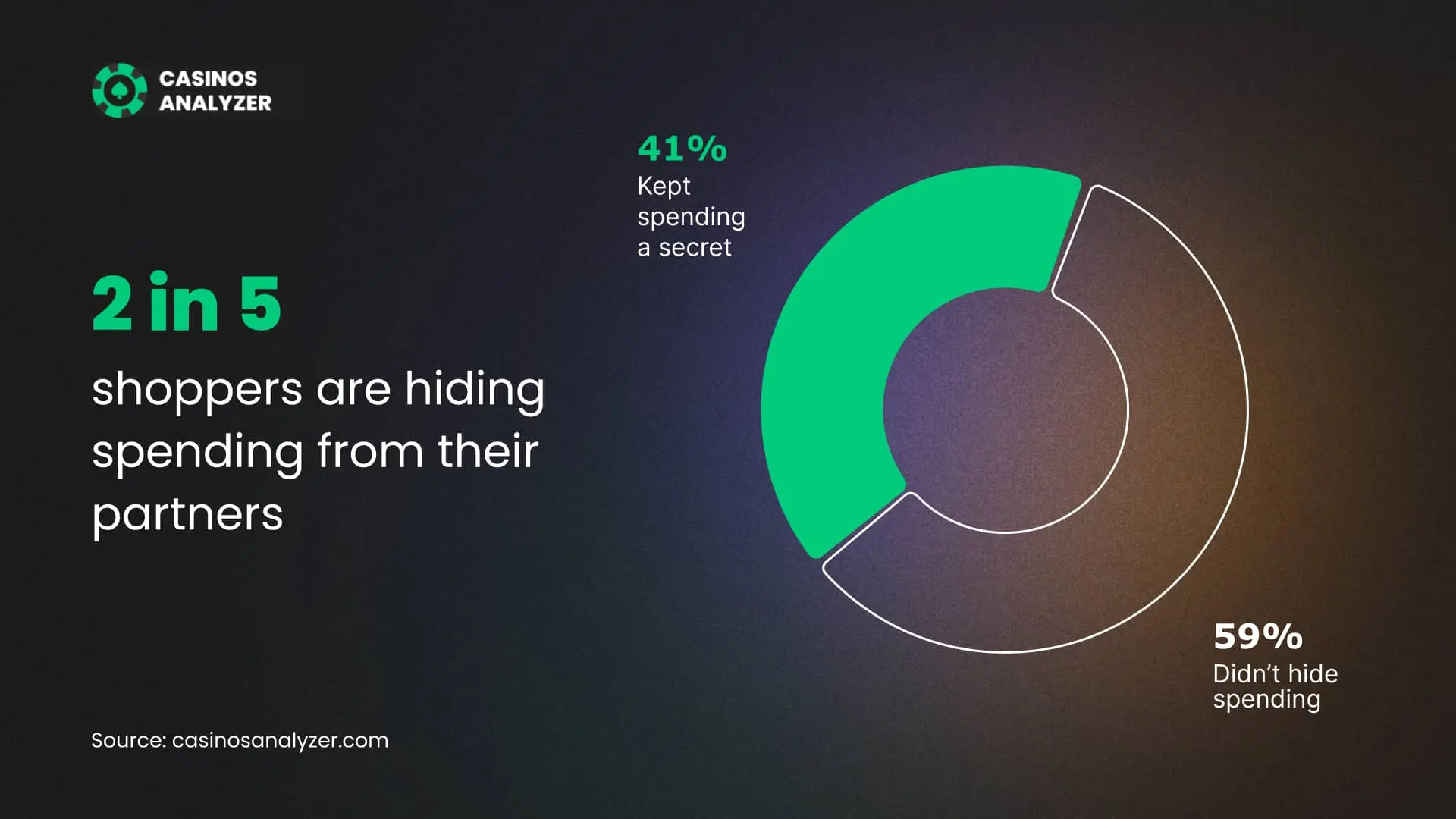

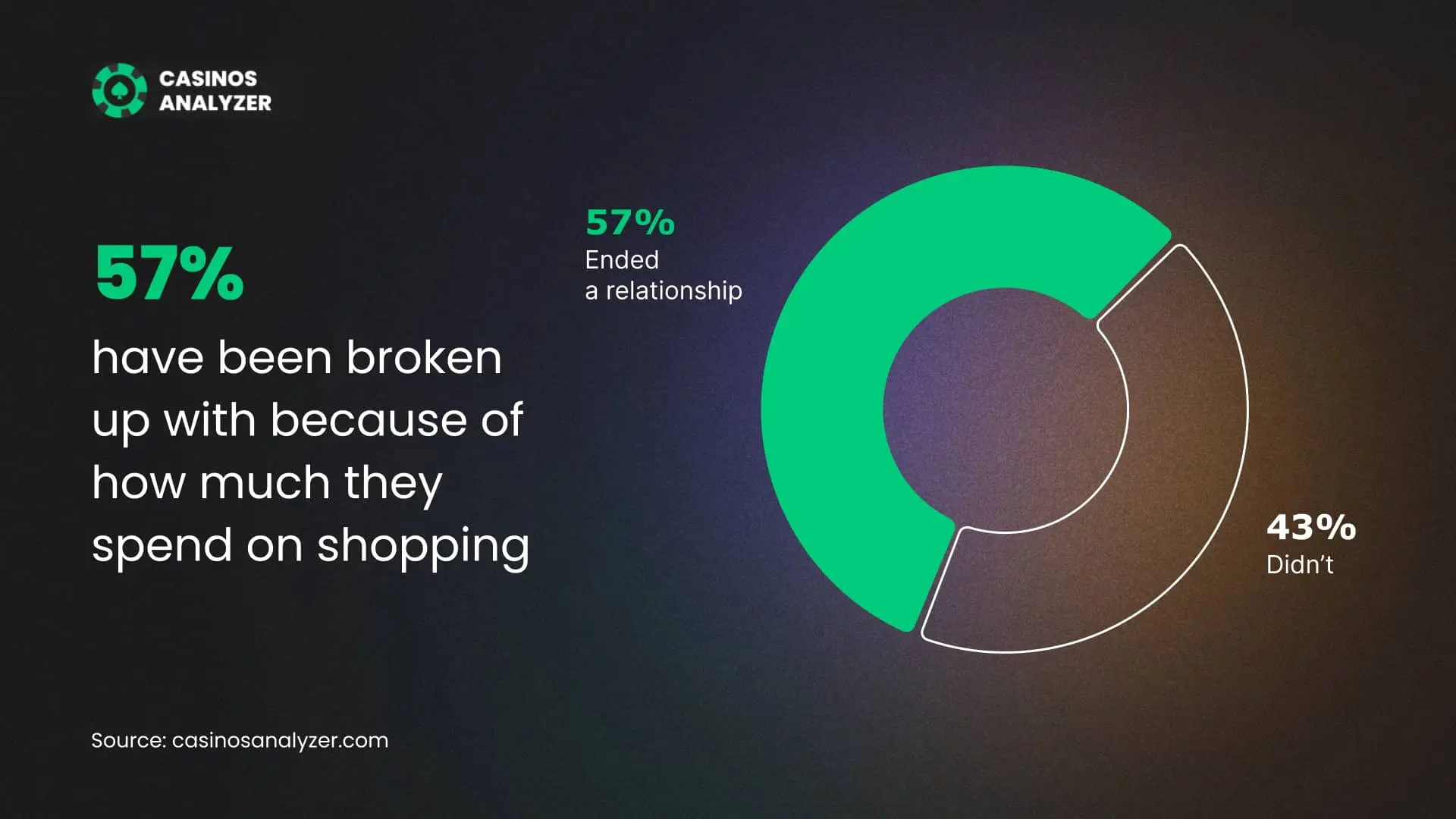

- 41% admit to hiding spending from their partner, and for some, the consequences are serious: 57% say their relationship ended because of their spending habits

Broke by the beach: Summer sales leave wallets scorched

Summer is supposed to be a time to relax. But for nearly 8 in 10 shoppers, it also means spending — and a lot of it. A full 77% plan to dive into summer sales this year.

What’s more surprising is how far they’re willing to go. While 53% say they’ll try to stay under a third of their income, around 40% plan to spend half or more of their salary, and some even expect to outspend what they earn.

And yet, the drive to buy doesn’t just come from logic. It’s driven by emotion — a mix of anticipation, urgency, and the satisfaction that comes from feeling like you’ve scored a deal.

From discounts to debt: The cost of chasing deals

The numbers get more personal from here. More than half of shoppers (51%) say they’ve borrowed money from friends just to catch a deal. Not for rent or bills, but for something on sale. It’s the kind of quiet financial stretch few talk about — but clearly, it’s common.

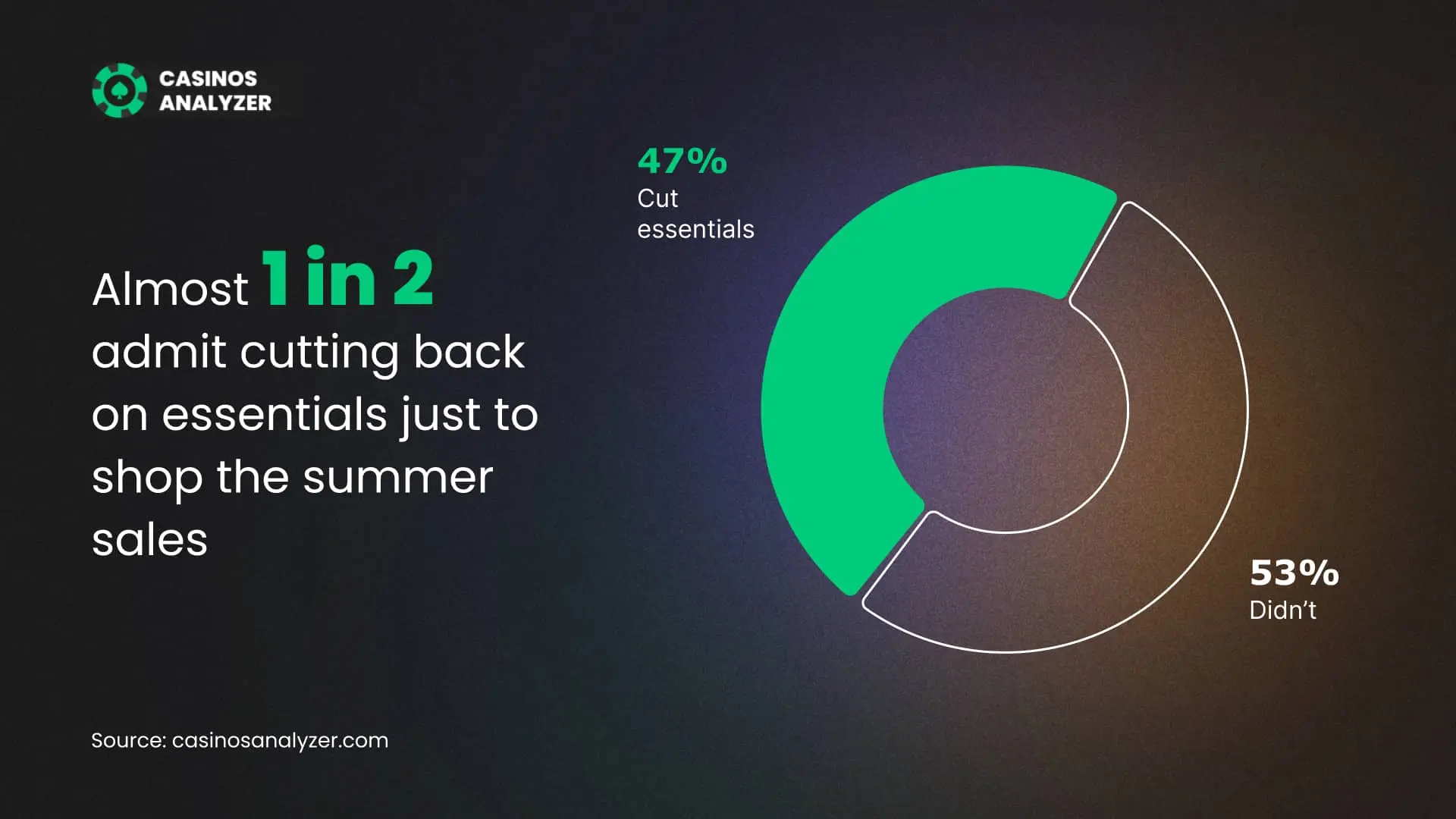

When borrowing isn`t an option, some simply shift their priorities. 47% admit they’ve cut back on essentials like groceries, utilities, or transportation just to make a purchase, rearranging basic needs to make space for a discount.

And for 1 in 3, that “great deal” came at a cost much steeper than expected: missing payments on rent, utilities, or loans. Just a few too many purchases, and the basics start to slip.

Shame, secrecy, and sales: The emotional fallout

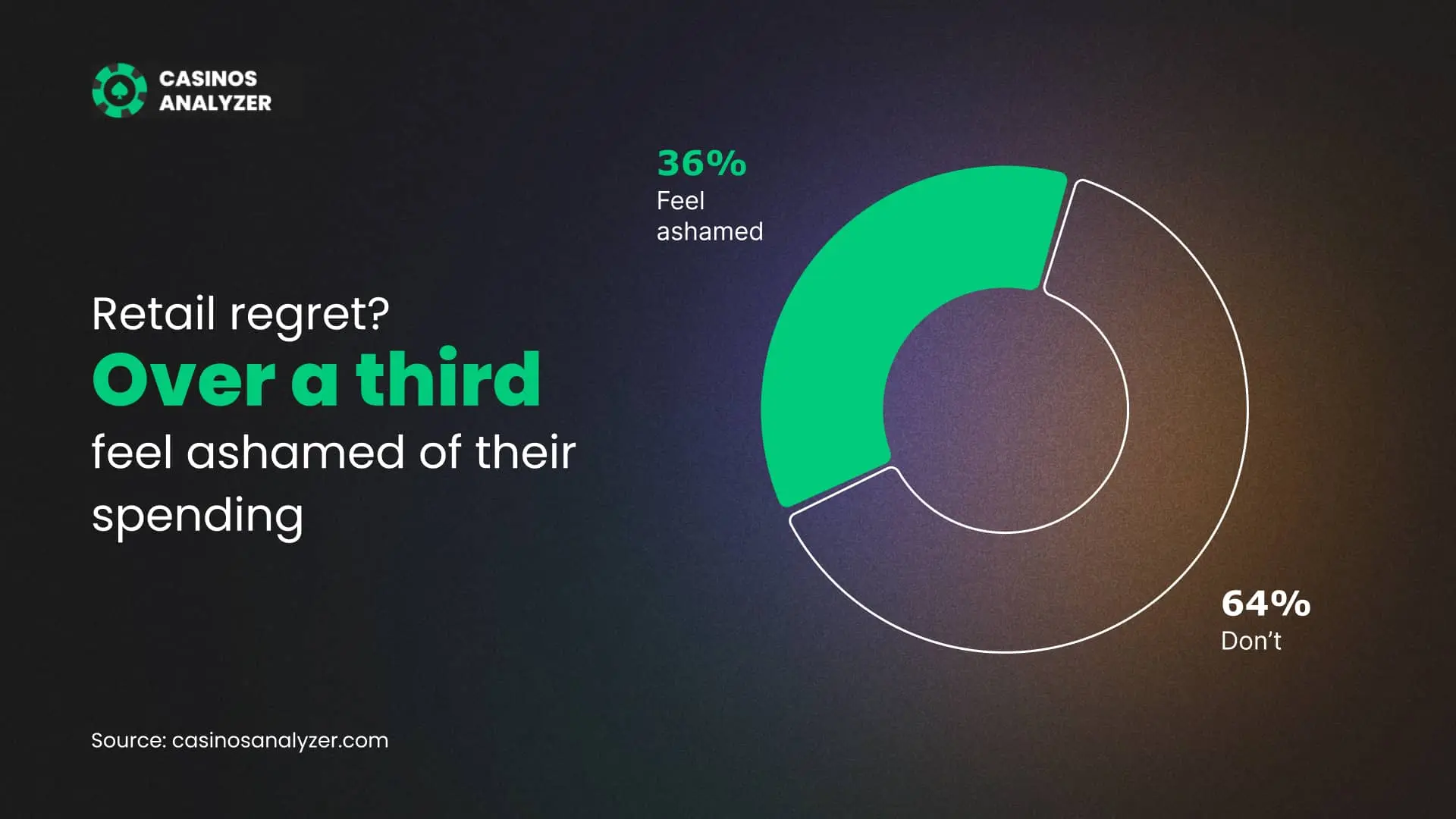

More than a third of respondents,36%, say they feel ashamed of how much they spend. This isn’t just fleeting regret. It’s guilt that lingers quietly in the background, long after the package has arrived and the excitement has faded.

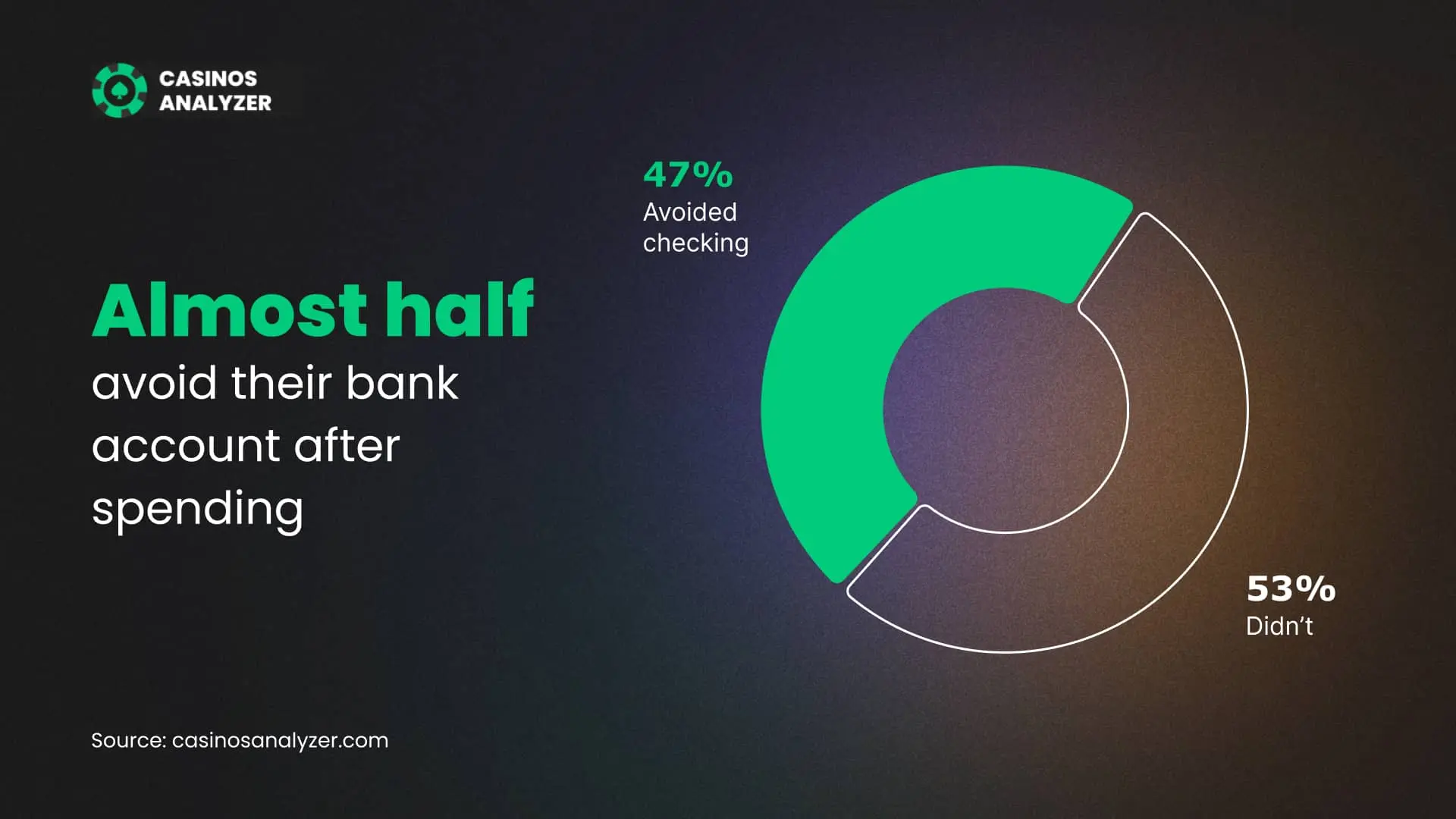

Nearly half (47%) admit they’ve intentionally avoided checking their bank account after shopping. Not because they forgot, but because they didn’t want to see the damage. It’s a quiet kind of denial, and it’s incredibly common.

Sometimes it’s easier to conceal than to explain. 41% of people say they’ve hidden purchases from a partner, whether that means leaving bags in the car, editing the truth, or skipping the conversation entirely. It’s not always malicious — often, it’s rooted in fear of judgment or conflict.

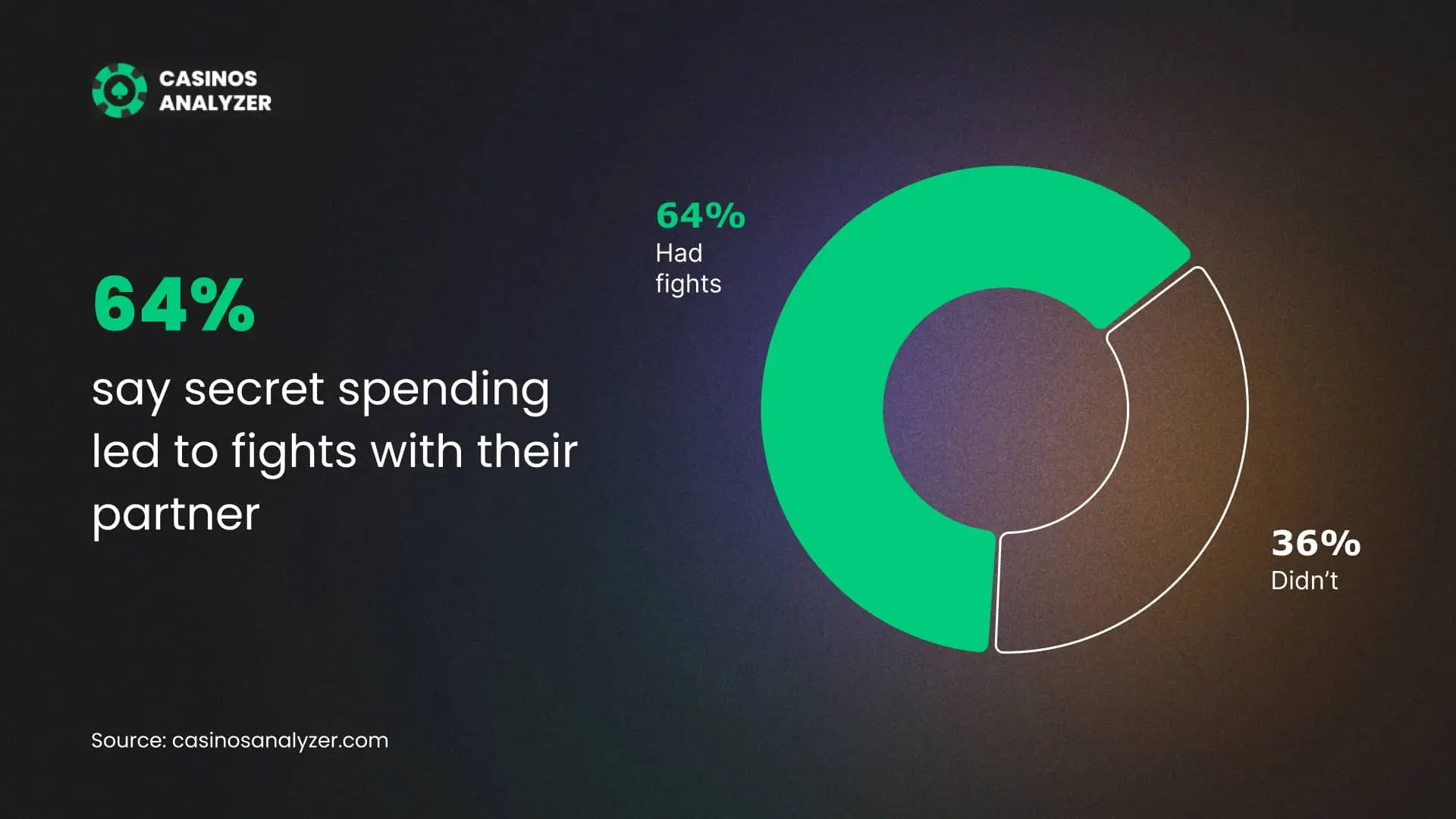

64% of those who’ve hidden spending say it led to tension or full-blown arguments. What starts as a small act of secrecy can unravel into mistrust, especially when money is already tight.

And for 57%, it ended the relationship entirely. When purchases become patterns and communication breaks down, money stops being just a financial issue — it becomes a relationship one.

Impulse or addiction? When shopping feels out of control

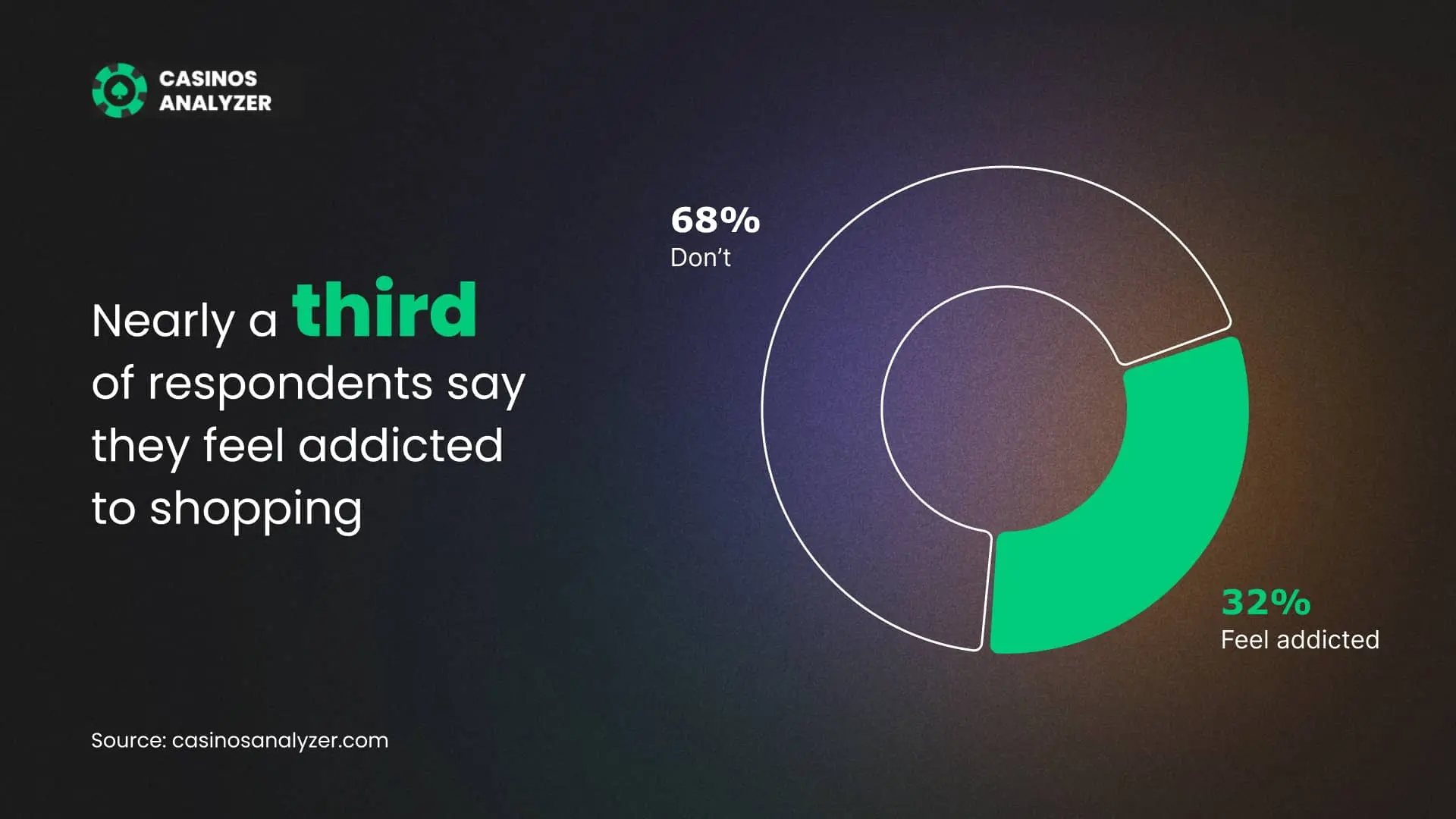

Shopping is meant to feel good. The urgency, the limited-time offers — all of it is built to create a rush. But for many, that rush becomes hard to resist. Nearly one in three shoppers say they feel addicted.

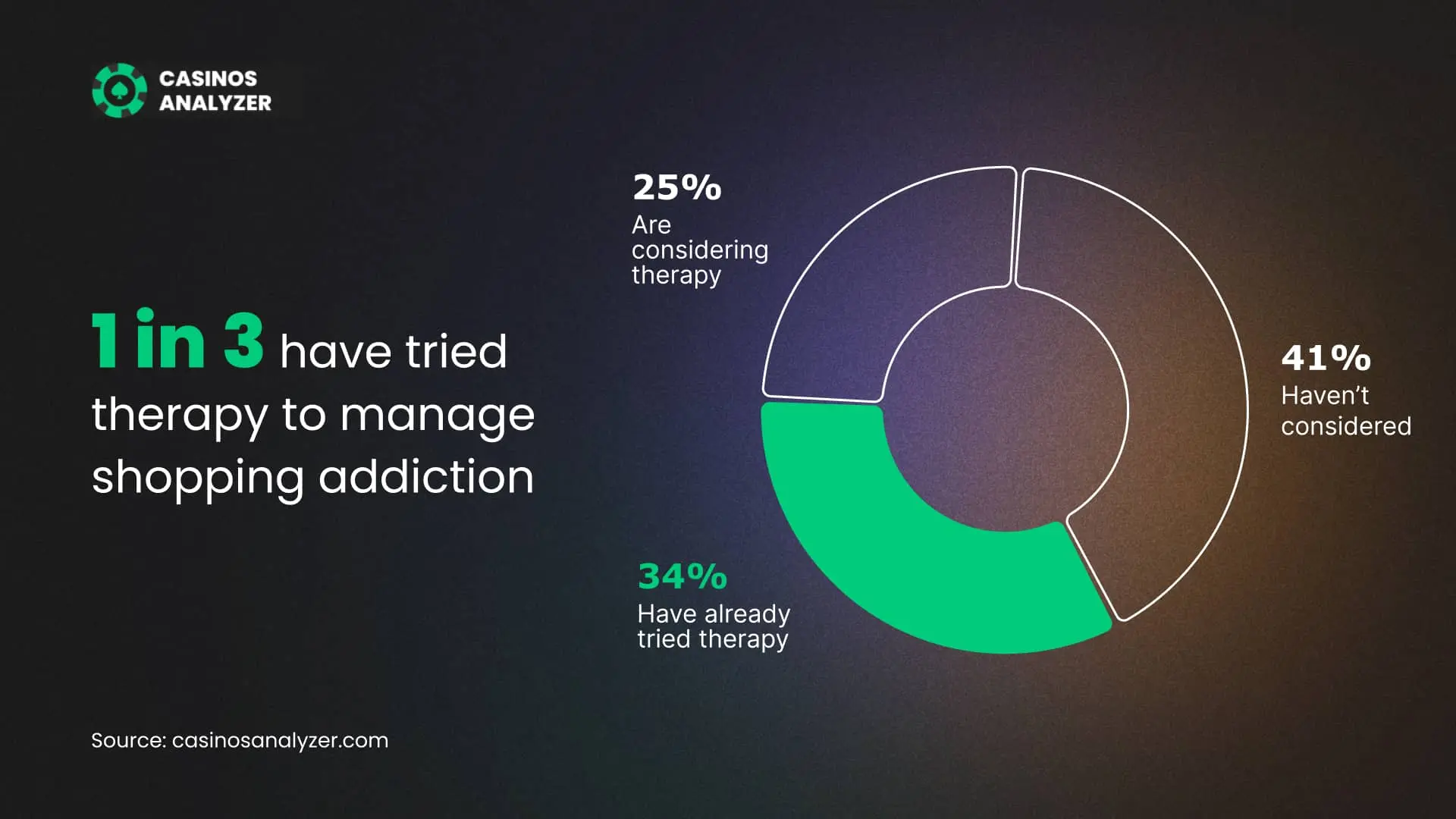

And while it might sound dramatic to link sales with therapy, a growing number of people are taking it seriously. 25% of respondents have considered seeking professional help, and about a third say they already have. That’s not about shame — it’s about recognizing a cycle and wanting to get out of it.

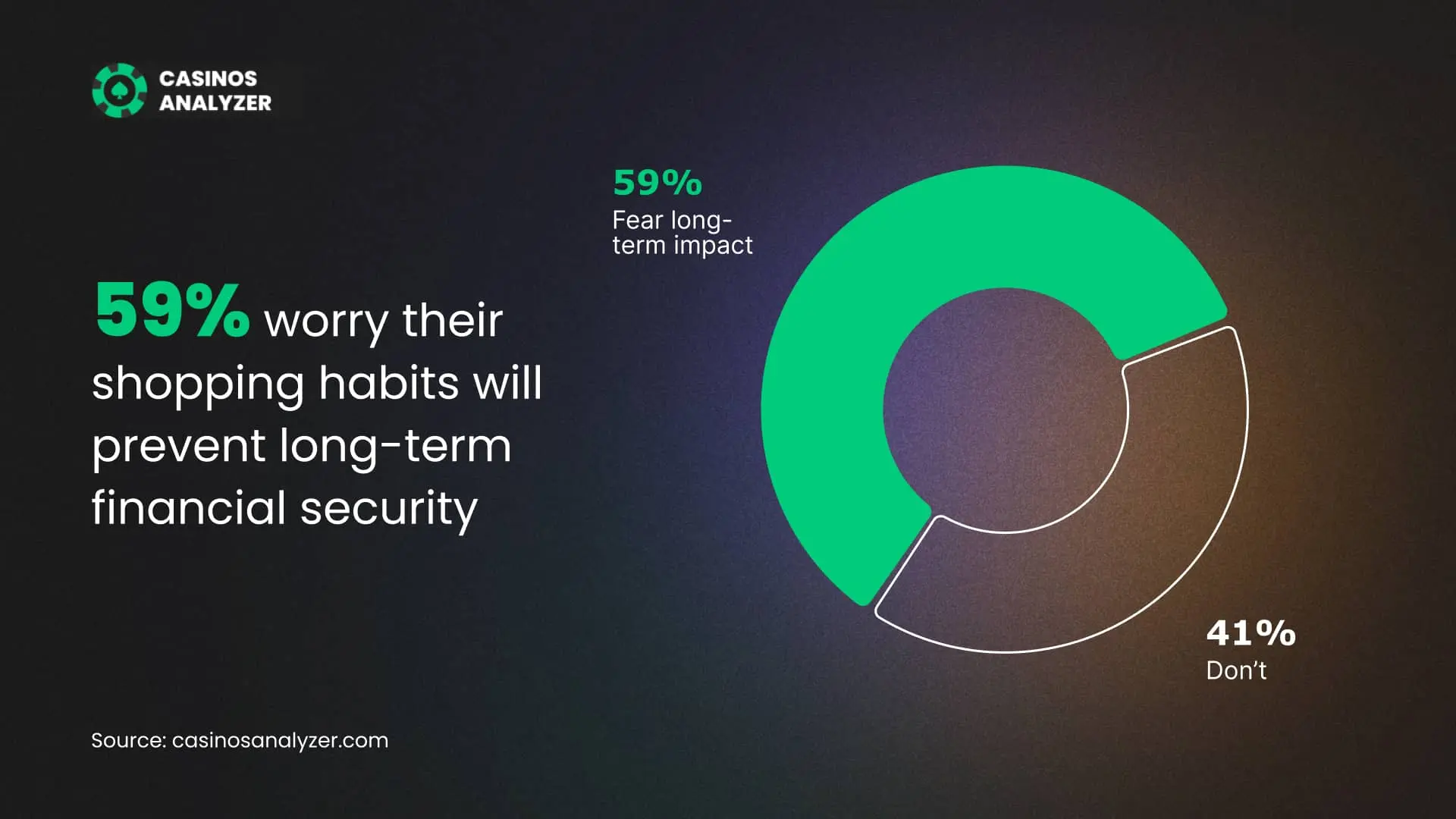

59% of respondents say they worry their current shopping habits could prevent them from ever reaching financial stability. And it’s not about one regrettable purchase or a single month of overspending. For many, it’s an ongoing cycle that gradually chips away at long-term peace of mind.

The deal breaker: Why we buy what we don’t need

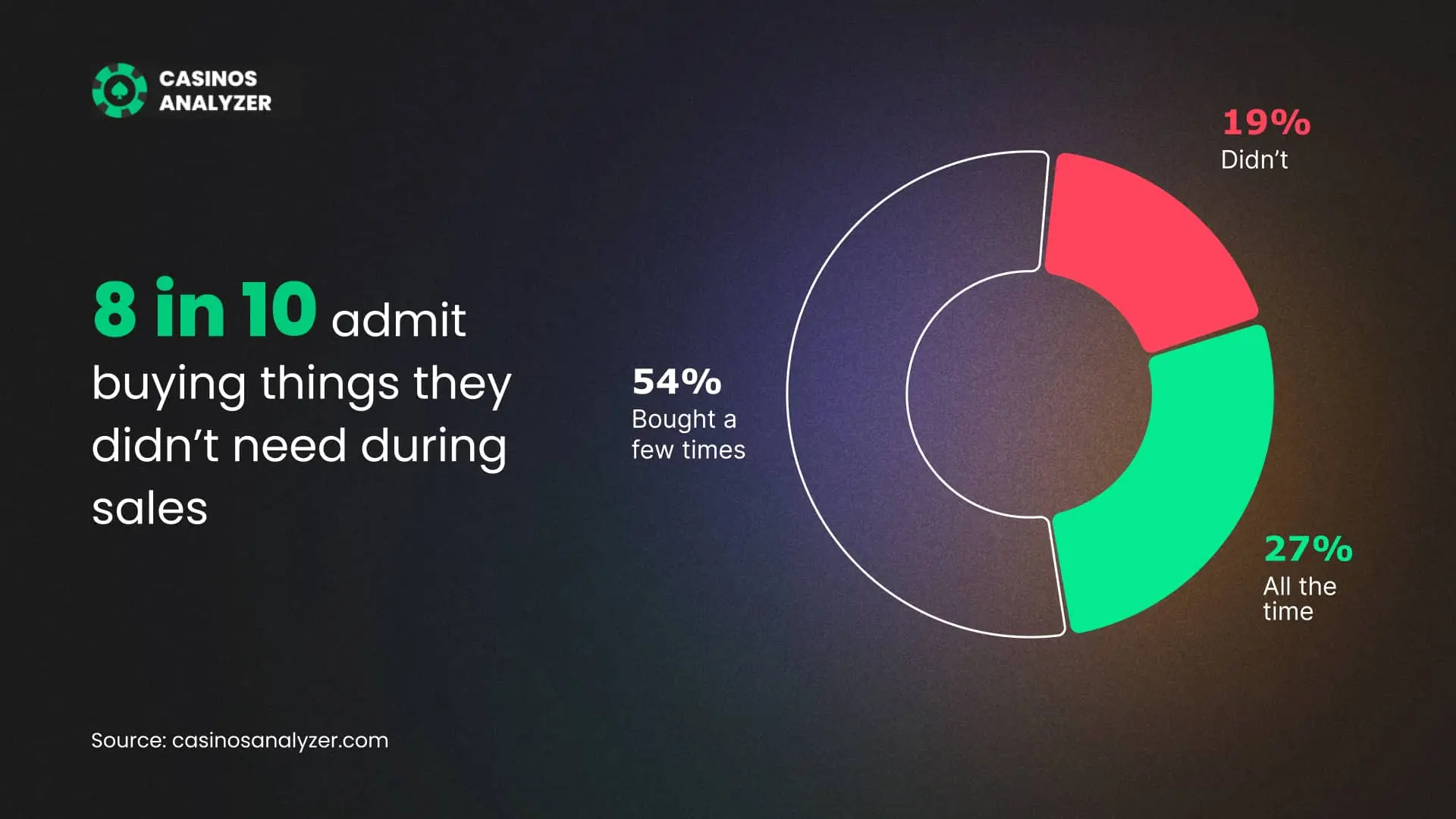

Sometimes, we buy just for the sake of it. 54% of people admit to purchasing items during sales they didn’t need, and 27% say it happens regularly. These aren’t one-off splurges. They show a pattern where the lure of a discount outweighs the actual usefulness of the purchase.

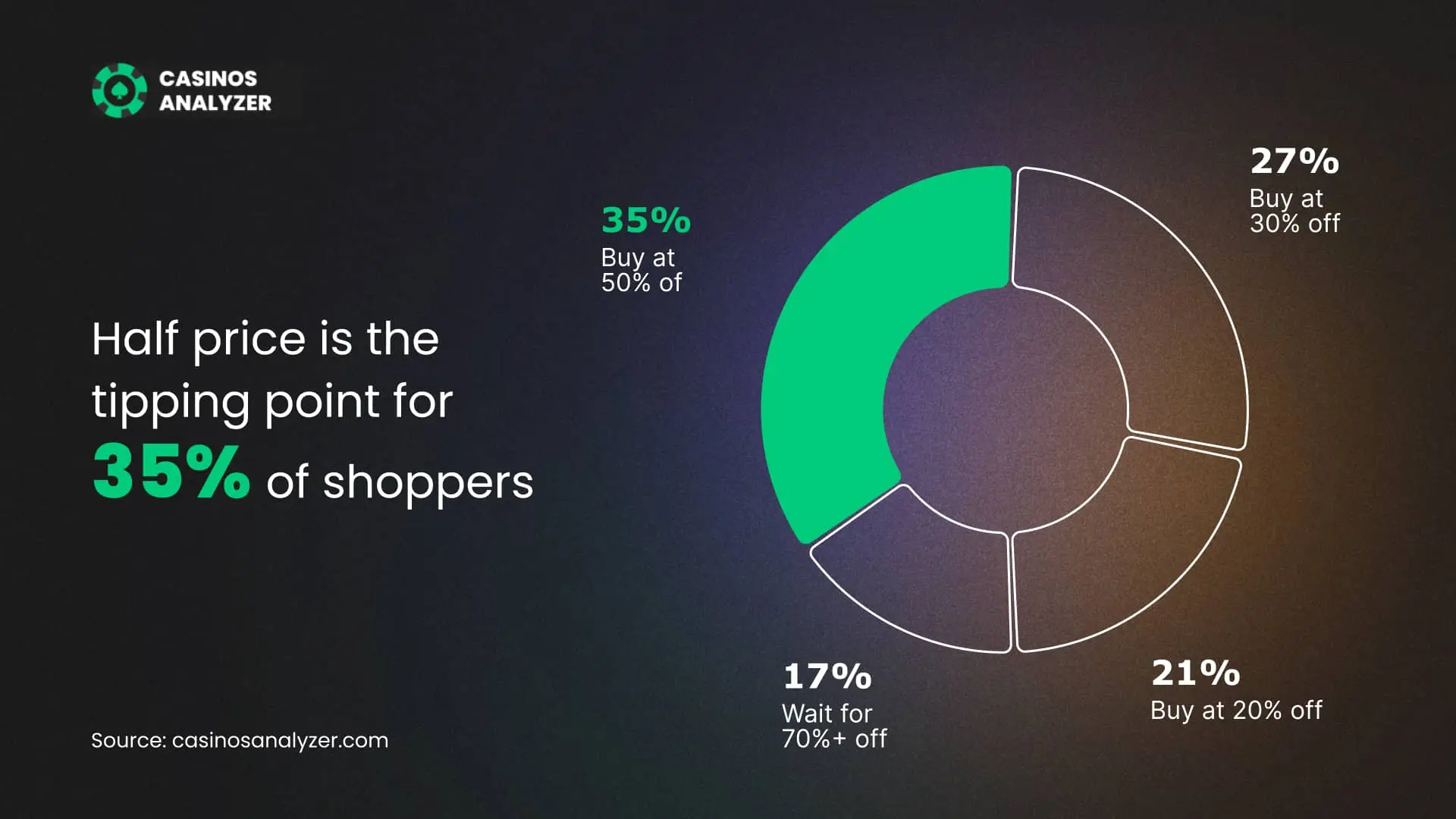

So what makes us pull the trigger? For the third of shoppers, it’s a 50% discount. That’s the moment hesitation fades and a deal feels too good to ignore — even if the item wasn’t needed. Logic takes a backseat to urgency, driven by the feeling that something valuable might disappear if they don’t move fast.

Methodology: To conduct this study, Casinos Analyzer surveyed 1,500 respondents of all genders, aged 21 and over.