Back-to-school shopping is breaking parents – and their budgets

Key takeaways:

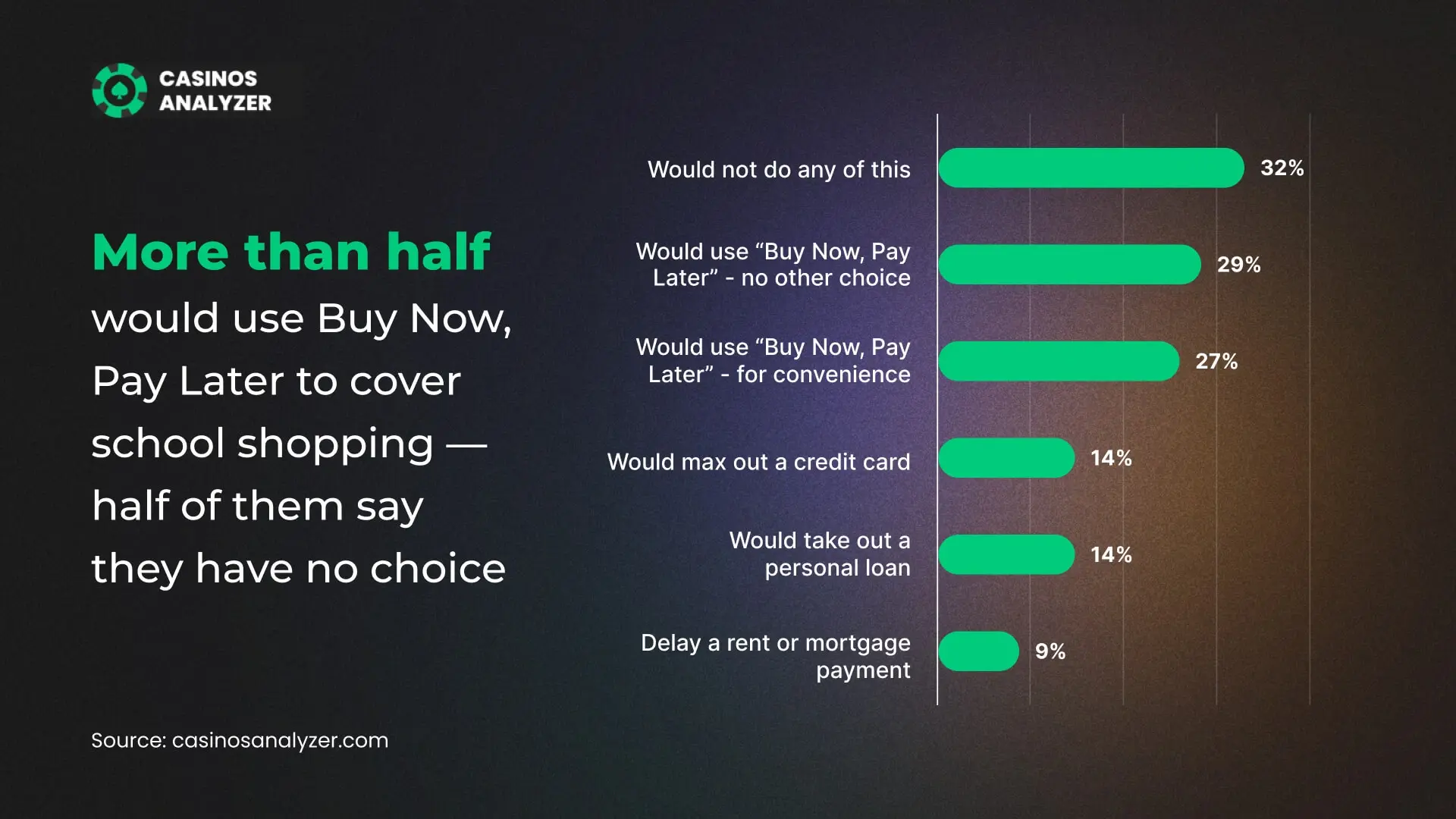

- 56% will use Buy Now, Pay Later to cover school costs – and half of them say they have no choice.

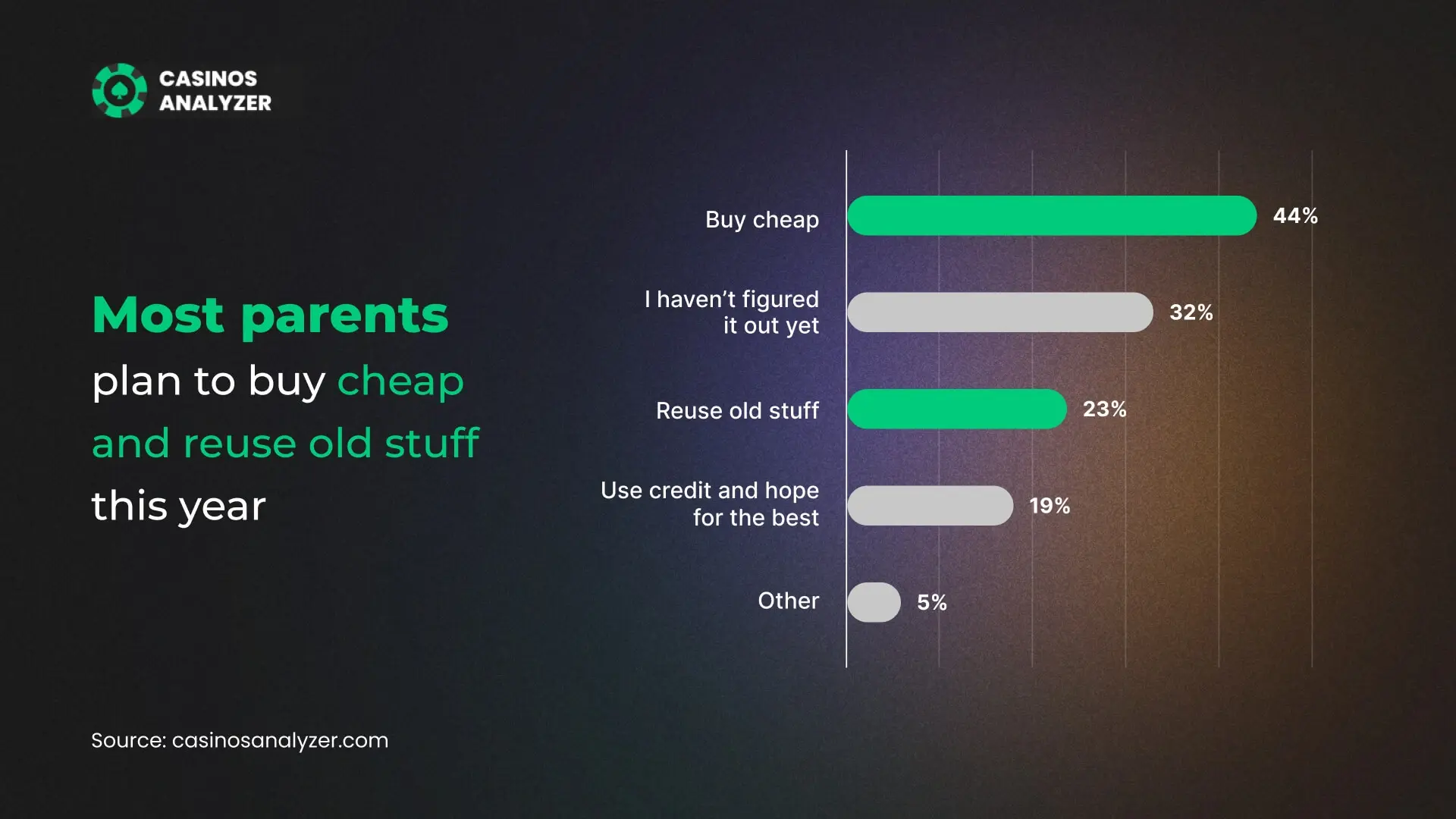

- 44% will buy the cheapest options possible this year, and 23% will reuse old supplies.

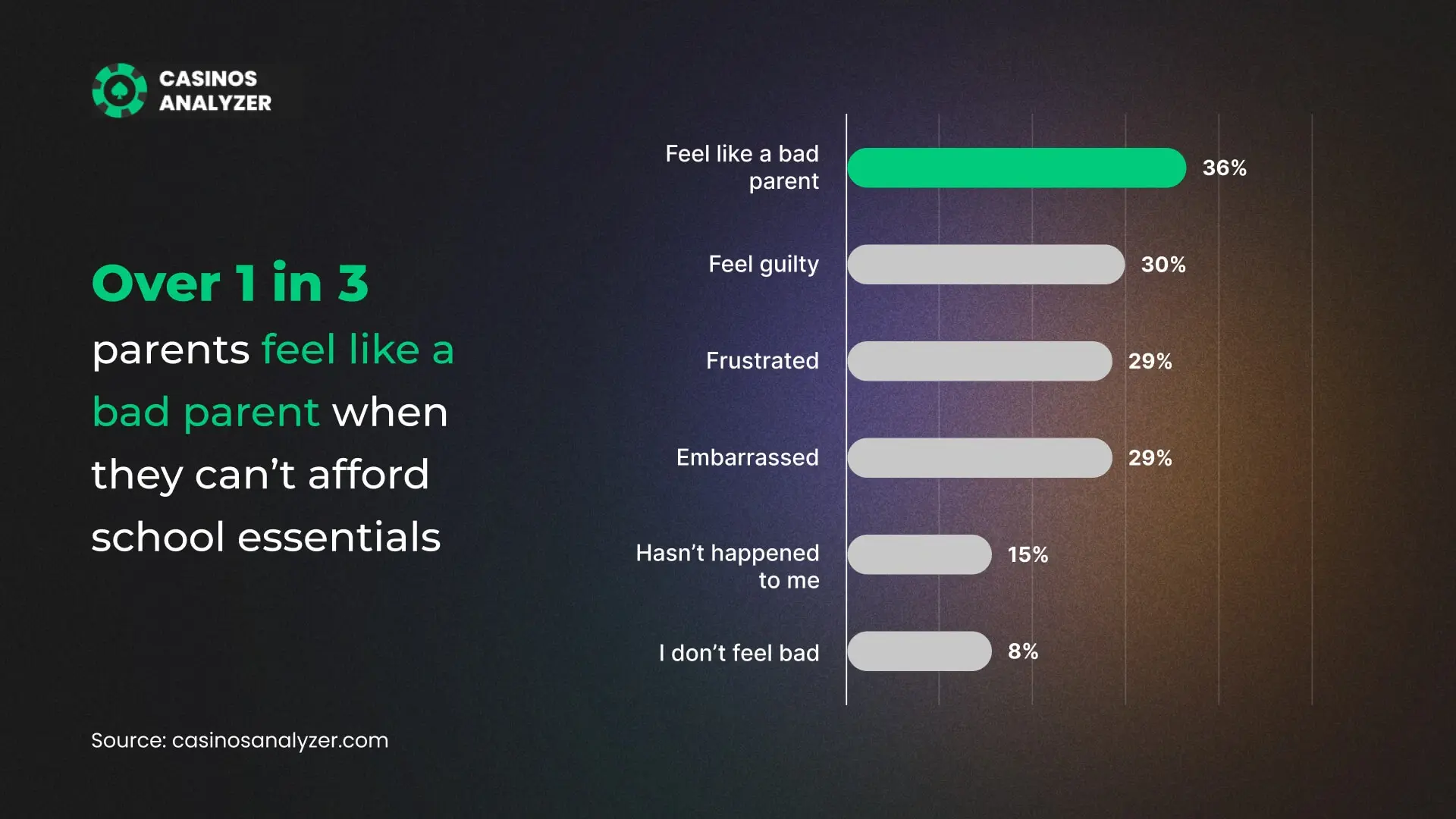

- 36% feel like a bad parent when they can’t afford school essentials.

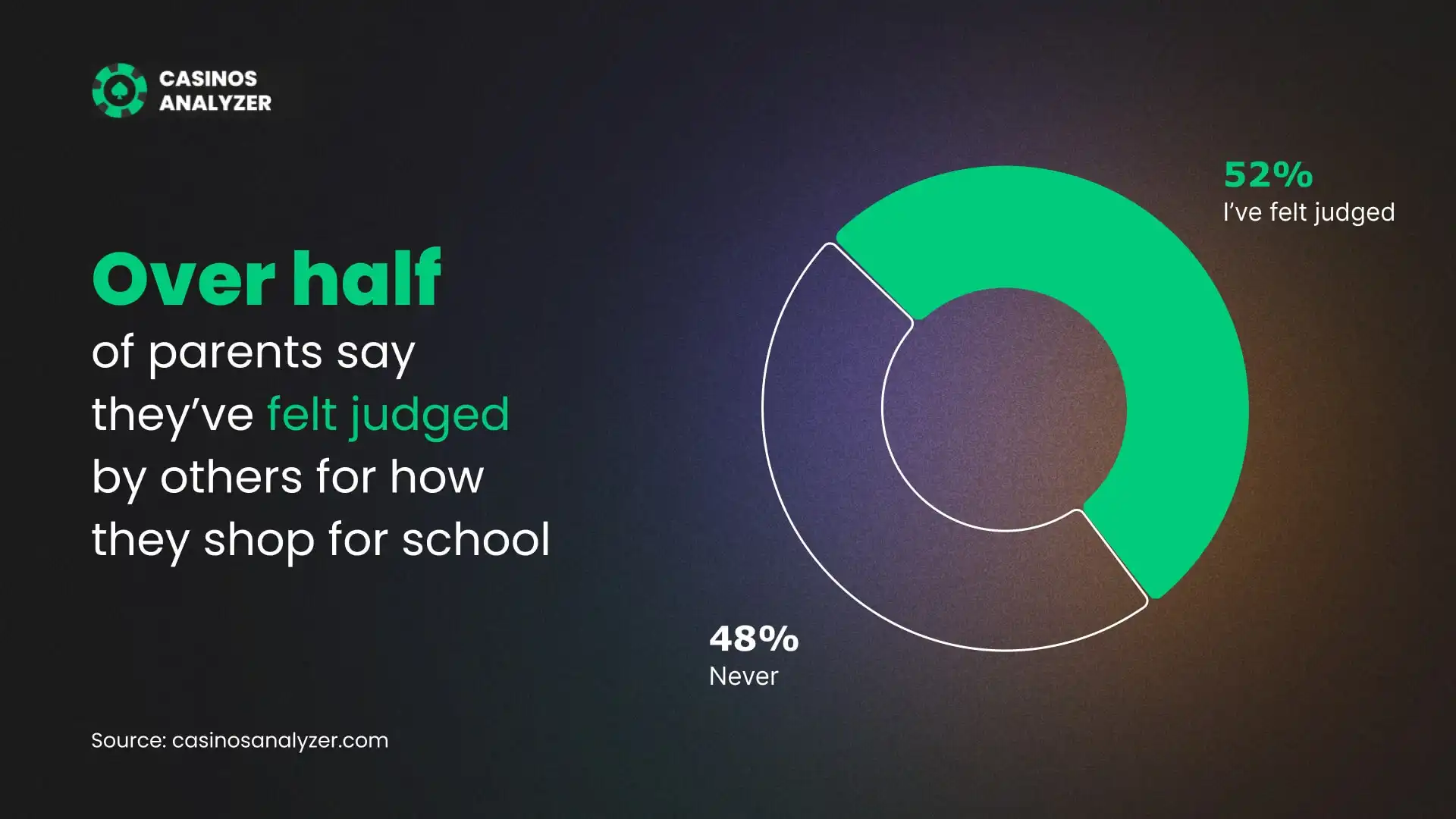

- 52% have felt judged by other parents for how they shop and what they can afford.

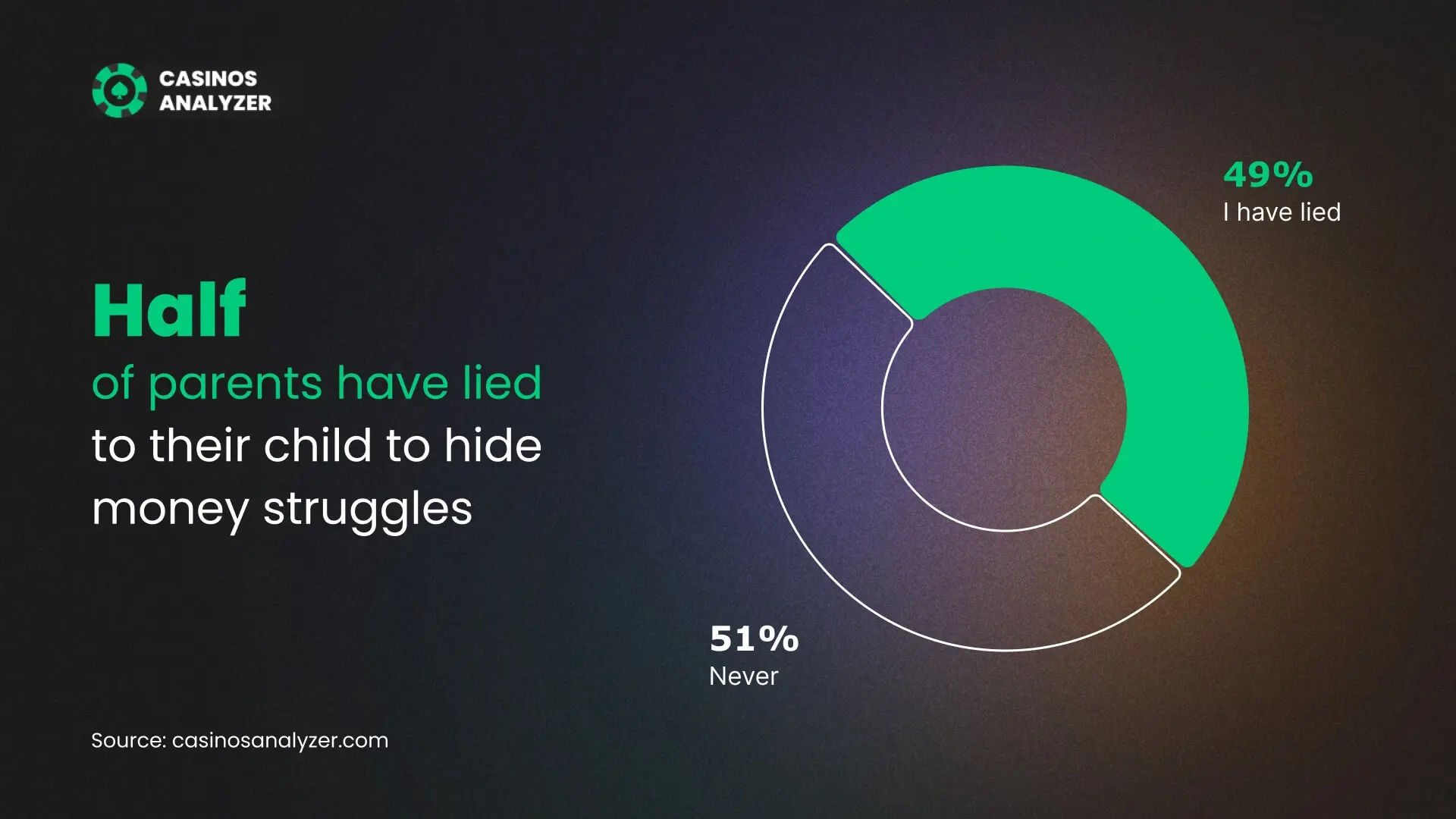

- 49% have lied to their child about why they couldn’t buy something.

- 46% admit to arguing with their partner over school shopping.

Parents are cutting back to afford back-to-school shopping

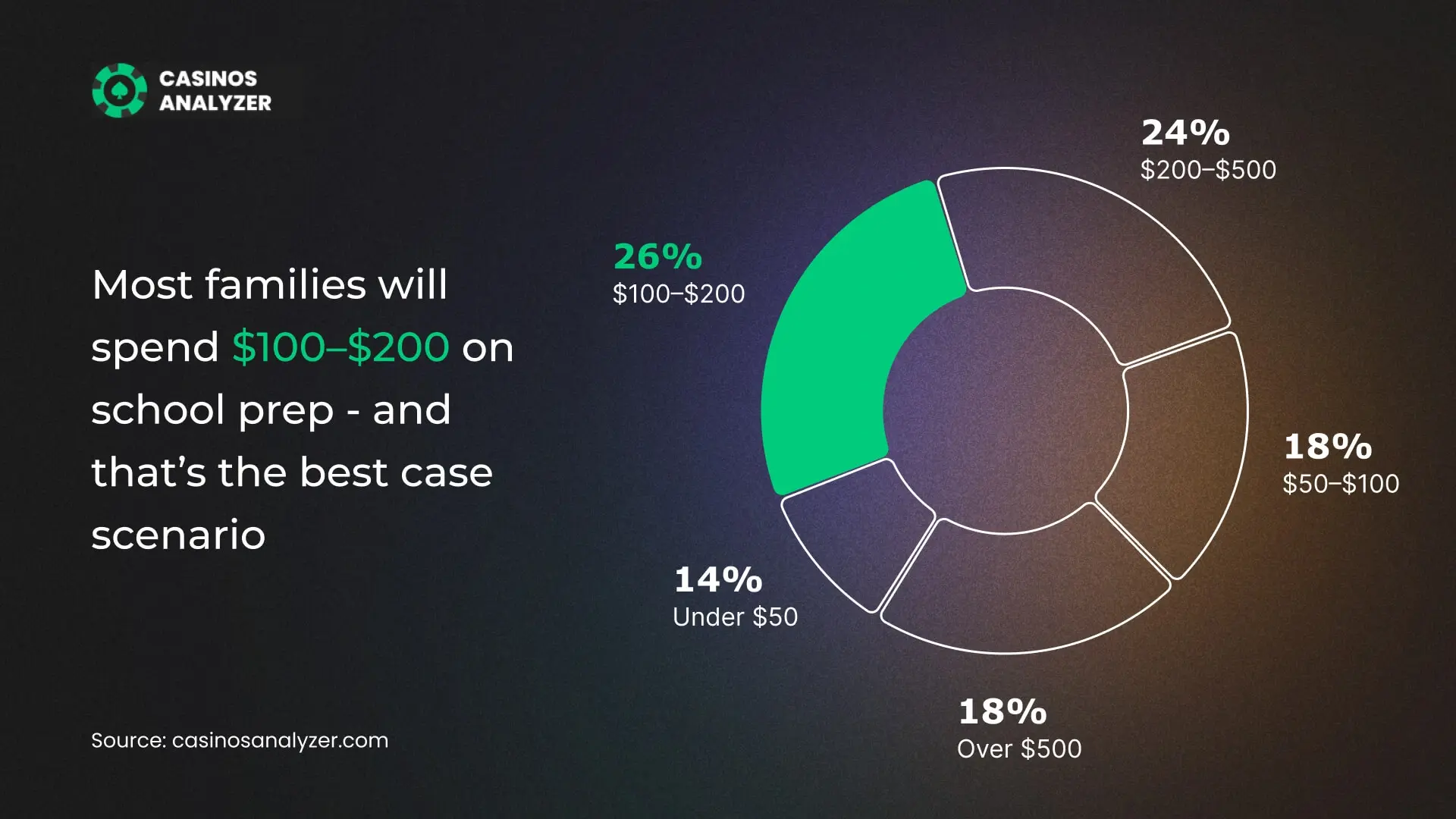

The majority of parents (26%) plan to spend $100–$200 this year, while 24% are preparing for a bigger bill of $200–$500. Inflation means even the “average” spend feels heavier than before. Supplies, clothes, and fees are eating into budgets, and fewer families can keep other essentials untouched.

Back-to-school now rivals the holidays. A third (30%) say school shopping is worse than Christmas, and about 40% say it’s about the same. With prices climbing on basics like shoes, uniforms, and supplies, August has effectively become a second peak season for household budgets.

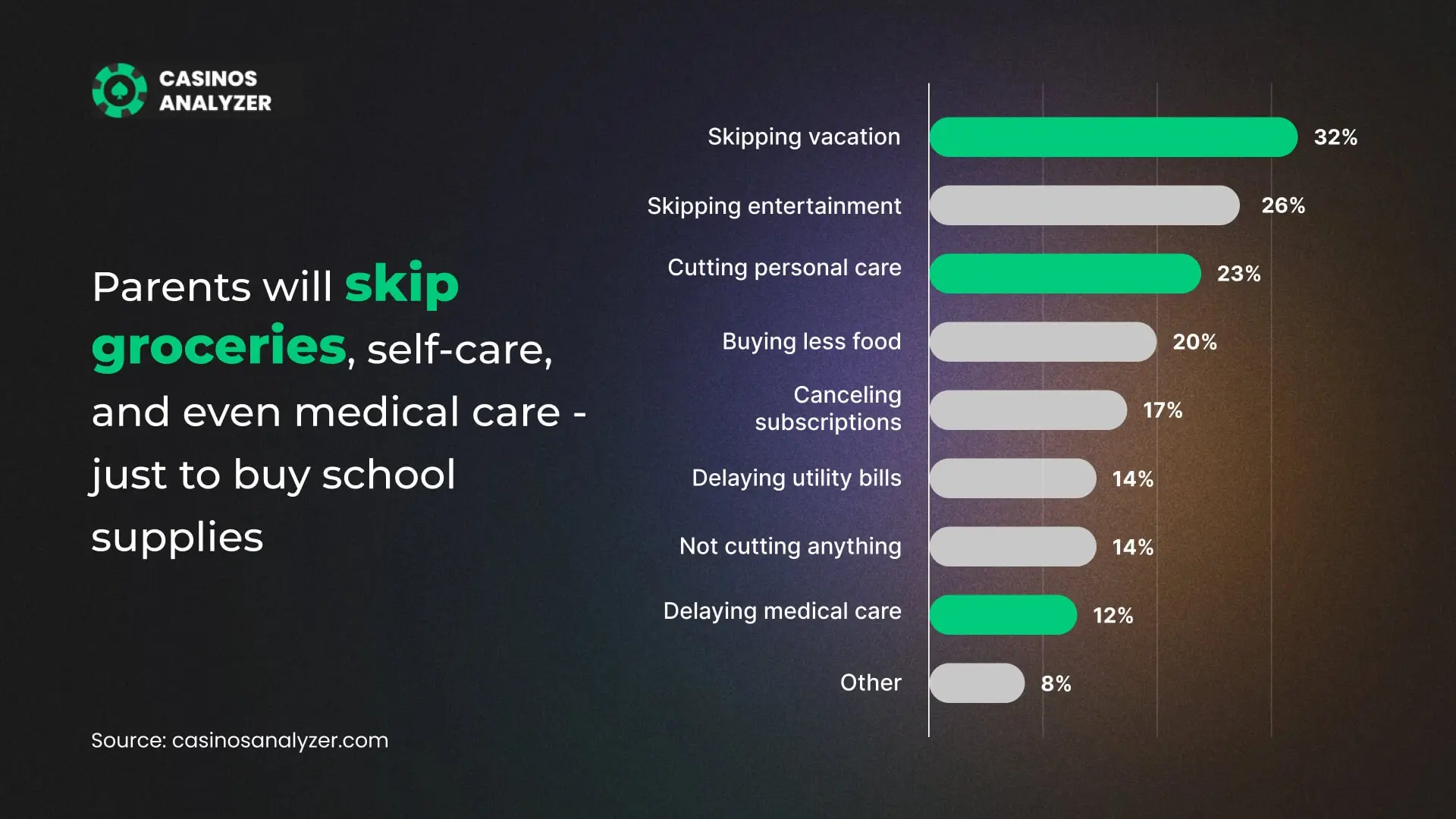

Covering the cost of school often means cutting something else. Nearly a third of parents (32%) will skip vacations entirely. Others are scaling back family outings, personal care, and groceries. And 12% will delay medical or dental care – a choice few want to make, but many feel they have no way around.

To make it work, parents are leaning on payment tactics that stretch far beyond payday. More than half (56%) say they’ll use Buy Now, Pay Later this season, and half of those admit it’s because they have no other choice. Some will resort to maxing out credit cards, taking personal loans, or even pushing back rent or mortgage payments – all to get their kids what they need for school.

Buying cheap is the plan for 44% of parents. Another 23% will reuse last year’s supplies. These aren’t just clever budgeting tricks – for many, they’re the only way to get through the season without going into deeper debt.

Financial stress is taking an emotional toll on families

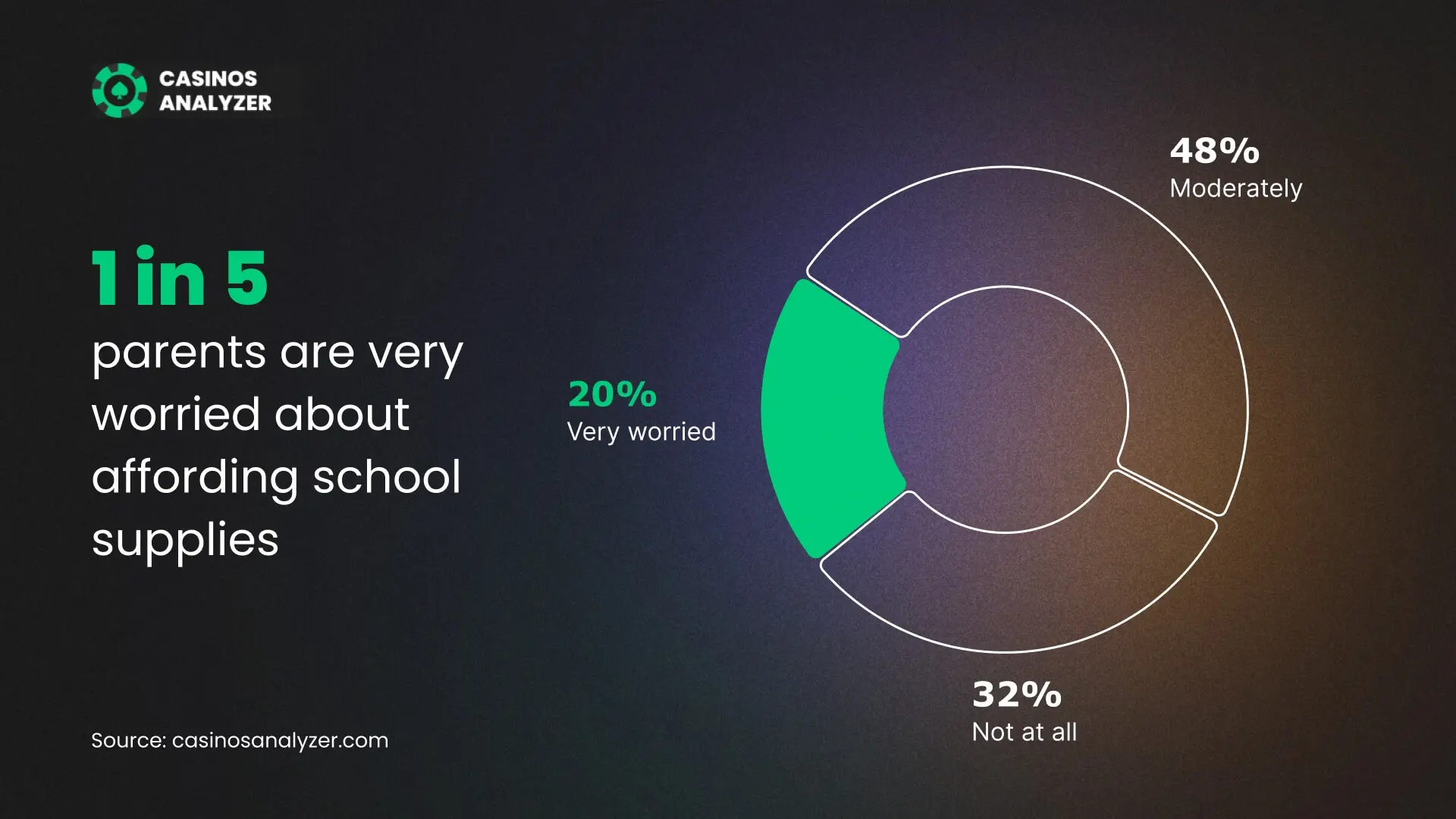

The worry is widespread – 20% are very worried, and nearly half are moderately concerned. This level of stress makes the back-to-school season feel less like a fresh start and more like a financial deadline.

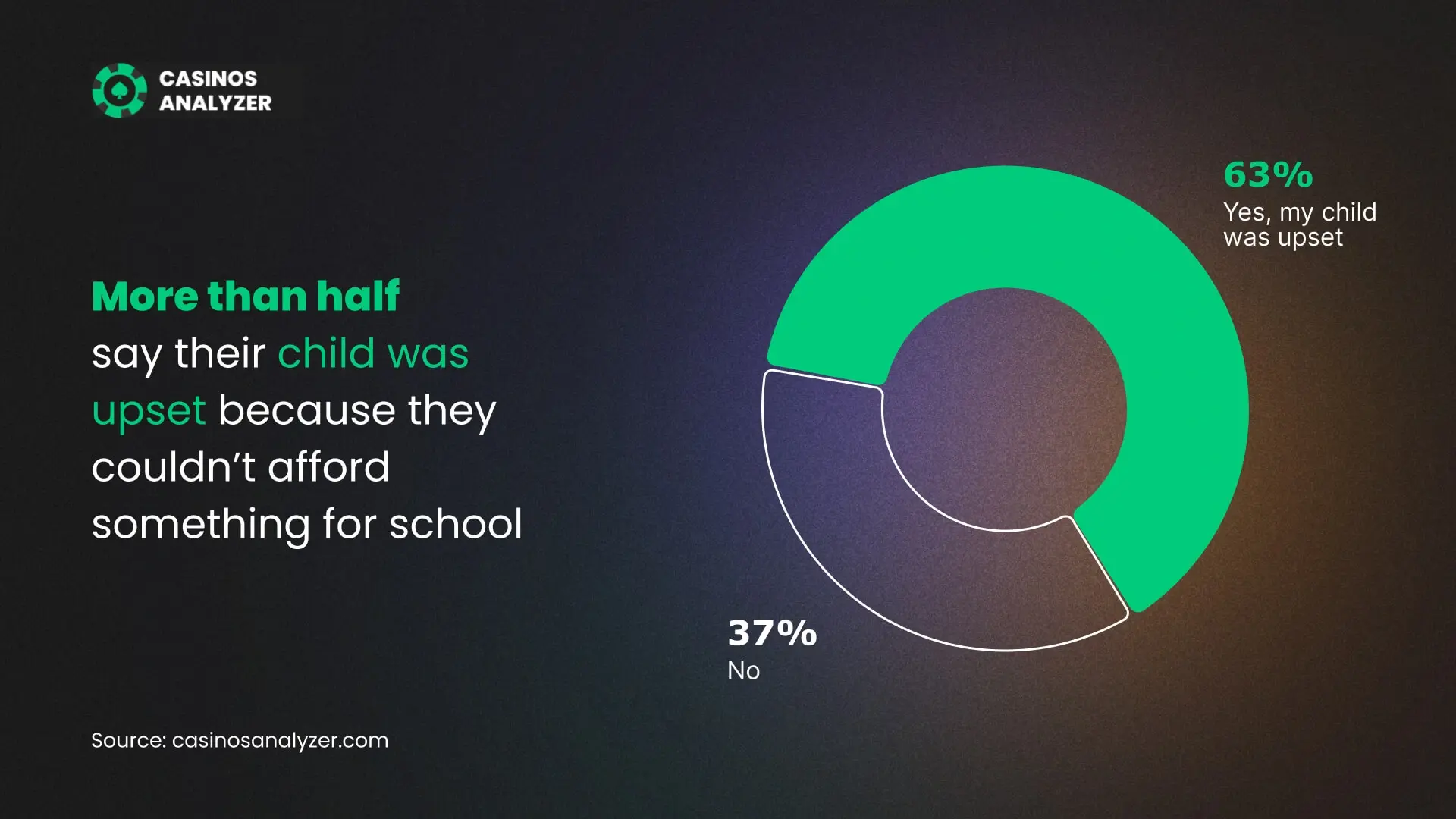

School shopping isn’t just stressful for parents – kids feel it too. Nearly two-thirds (63%) have had a child upset because they couldn’t get something they needed or wanted for the new school year, often essentials like uniforms, sports equipment, or supplies.

36% of parents say they’ve felt like a bad parent when they couldn’t afford school essentials. On top of that comes guilt, frustration, and embarrassment – a mix that can turn a simple shopping trip into a heavy emotional burden.

For some, avoiding a tough conversation feels easier than explaining money problems. Nearly half (49%) have lied and told their child something was “out of stock” or “not needed yet” rather than admit they couldn’t afford it.

Back-to-school stress is spilling over into relationships

Arguments aren’t rare this time of year – 46% of parents say they’ve clashed with their partner over school shopping. The disagreements often center on what’s essential, how much to spend, or which bills can be postponed.

Social pressure is making school shopping even harder

It’s not just the bills – it’s the judgment. 52% of parents have felt looked down on for how they shop and what they can afford, whether that’s buying secondhand, skipping name brands, or reusing last year’s backpack.

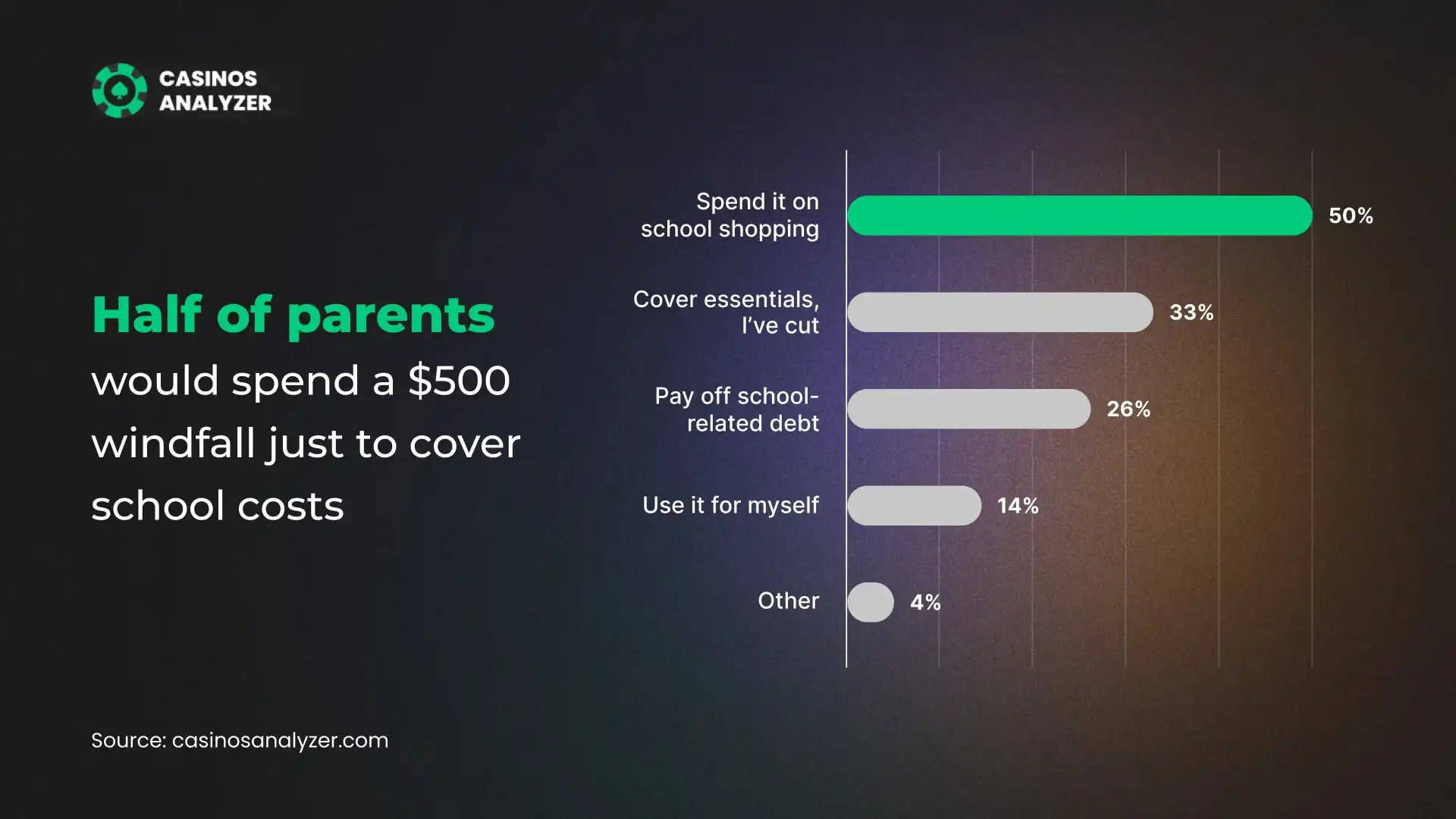

If $500 showed up today, parents say it’s already spent

Half wouldn’t hesitate – they’d spend it on school shopping right away. A third would restore essentials they’ve already cut, and over a quarter would use it to pay off school-related debt. Almost no one would keep it for themselves, underscoring just how consuming the costs have become.