A New Peak Has Been Conquered - : The Bitcoin Rate Updated Historical Maximum

Introduction to Bitcoins Historic Surge

Bitcoin is the first and most expensive digital currency on the market. BTC coins have been traded for a decade and a half and have a high value. Moreover, Bitcoins current price surge has captivated the financial world, hitting $70,000 and marking its highest point since June. This impressive climb is significant for new and seasoned investors as it highlights Bitcoins resilience and the continued interest in cryptocurrency as a viable investment. Let's explore what's behind this historic price level and what it might mean for the future of Bitcoin price after June and the wider cryptocurrency market.

The first digital currency was made on the basis of blockchain technology. Satoshi Nakamoto is considered the creator of BTC today. However, this is still an unknown person who gave us BTC tokens with a decentralized nature. The peer-to-peer network allows, using a private key, to send and receive transactions to your hardware wallet. Many of the principles laid down by Satoshi Nakamoto (highly volatile token, decentralized cryptocurrency, true identity) in the first cryptocurrency and the existing blockchain are used by other digital coins.

Satoshi Nakamoto, who created Bitcoin, took care of its convenience. And if Bitcoin mining and cryptocurrency transactions were something amazing back then, today users conduct large quantities on various crypto wallets. You can send or receive transactions from anywhere in the country without notifying the central bank and without wasting time on coordination with financial institutions. Such convenience of Bitcoin transactions made it not just the first cryptocurrency - it is the leading cryptocurrency with blockchain technology.

If you want to buy Bitcoin or sell Bitcoin, you need to know how does Bitcoin works. Thanks to our article, you will learn about such concepts as Bitcoin blockchain, Bitcoin network, Bitcoin protocol and many other useful information.

What Factors Pushed Bitcoin Price Beyond $70,000?

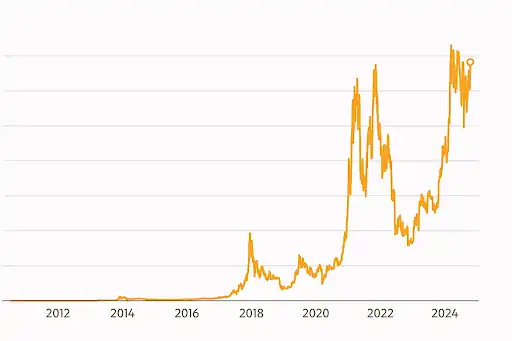

Many crypto holders know about the famous "Programmer Laszlo pizza," which the owner bought in 2012 for 10,000 Bitcoins. Given the Bitcoin current price of almost $74000 per coin, such a pizza would have USD price near $740,000,000! It's no wonder that this has become something of a Bitcoin meme. In this regard, some crypto holders even celebrate Bitcoin Pizza Day. But what contributed to such an increase in the value of Bitcoin over the years?

Several factors contributed to Bitcoins ascent to this new height. The ongoing adoption of digital currencies, institutional investments, and macroeconomic forces played roles. Economic uncertainty and inflation fears drove investors to seek alternatives, positioning Bitcoin as a "digital gold." Additionally, large-scale institutional investors have shown growing confidence in Bitcoin as a store of value.

Bitcoins Performance Compared to Other Cryptocurrencies

Bitcoin is the first cryptocurrency and the central coin in the world of cryptocurrencies. The value of altcoins largely depends on Bitcoin prices and follows these indicators. That is why many holders of other cryptocurrencies and large investors regularly monitor BTC news and make decisions based on them. While Bitcoin has surged, not all cryptocurrencies have followed suit equally. Bitcoins price action often serves as a bellwether for the market, and its dominance affects the overall trajectory of digital currencies. Altcoins like Ethereum and Litecoin also saw gains but have not matched Bitcoins record-breaking levels, highlighting Bitcoins unique position in the crypto ecosystem.

The Role of Institutional Investors

In 2020, we heard predictions that Bitcoin over time would cost more than $100,000 per coin. Now, we see a move in this direction, which is confirmed by the actions of large investors and positive Bitcoin news. Institutional interest in Bitcoin has increased significantly, with major corporations and investment funds adding Bitcoin to their portfolios. Companies such as Tesla and MicroStrategy are prime examples of how institutional backing can drive higher prices. The involvement of these heavyweights lends credibility to Bitcoin, encouraging other investors to follow suit.

The Impact of Global Economic Trends on Bitcoin Blockchain

Bitcoins rise is closely tied to global economic conditions. Inflation concerns, fears of economic instability, and currency devaluation have driven users to the digital asset to determine how much is 10 Bitcoin costs and invest their money. In times of economic uncertainty, Bitcoin is increasingly seen as a hedge similar to gold, helping to insulate portfolios from traditional market fluctuations. It's no surprise that the original price of Bitcoin is rising and breaking records.

Comparing Bitcoins 2023-2024 Performance to Past Years

Let's look at Bitcoin price history over the past years. Bitcoins current performance parallels past bull markets but with some key differences. Unlike in previous years, when retail investors largely drove the market, institutional investors now play a larger role. This change could contribute to a more sustainable growth trajectory, with reduced Bicoin volatility and higher price stability.

Why $70,000 is a Key Psychological Barrier for Bitcoin

Breaking the $70,000 mark is a well-known Bitcoin prediction 2024 and is significant because it acts as a psychological milestone that may influence investor behavior. When Bitcoin crosses major thresholds for the first time, it typically gains heightened media coverage and increased public interest, further fueling its $BTC price. These levels, once breached, can shift market sentiment, opening doors to potentially even higher price targets.

The Role of Media and Public Sentiment

The media has a powerful influence over price Bitcoin movements. Positive coverage on major news outlets and social media platforms has brought Bitcoin into the spotlight, attracting retail investors. Influencers and financial analysts have added to the excitement, promoting Bitcoin as a smart investment choice, which drives demand.

Bitcoin Transaction and Regulatory Pressures

Regulators and political-economic standoffs are major factors that can cause amazing growth or a Bitcoin crash. Regulatory actions worldwide have also influenced Bitcoins journey. Governments in major markets, such as the U.S. and China, have issued varying stances on cryptocurrency regulation, affecting market confidence. The increased price points bring Bitcoin BTC under closer scrutiny, and new regulations could affect its future.

What This Price Increase Means for Long-term Holders

Understanding what Bitcoins highest price means for long-term holders is also important. They can increase assets if the price of one Bitcoin is steadily growing, and luck was on their side this year. At the beginning of 2024, the cost was about 60 thousand, and by the end of the year, it was more than 74. If you want to know how much is 74 000 a year per hour, the answer is $8.45. This is how much a crypto holder received for Bitcoin 2024. For long-term holders, or "HODLers," this price increase vindicates their patience and faith in Bitcoins potential. However, as prices rise, so do the stakes, and HODLers need to stay aware of potential risks, including market volatility and regulatory shifts that could impact Bitcoins value.

Technical Analysis of Bitcoins Price Surge

From a technical perspective, news on Bitcoin is positive because the coin has crossed significant resistance levels, with $70,000 serving as both a target and support level. Analysts are watching closely for signs of retracement or consolidation, but current indicators suggest strong buying momentum. These technical patterns offer insights for investors looking to make informed decisions.

Bitcoin Mining and the Environmental Debate

Bitcoins environmental impact has long been a point of contention. Higher prices ofte lead to increased Bitcoin mining activity, which raises environmental concerns. As cryptocurrency reaches new Bitcoin tops, discussions about sustainable mining practices will likely intensify, emphasizing finding eco-friendly solutions to support Bitcoins growth.

How Will This Impact the Future of Bitcoin and Cryptocurrency Markets?

The $70,000 milestone could further grow Bitcoin and the broader cryptocurrency market. Analysts and industry experts believe that increased adoption and institutional interest may continue to propel Bitcoin upward. However, regulatory pressure and environmental issues remain, leading to the Bitcoin break.

Bitcoin Investment Strategies at $70,000 and Beyond

If we look at the Bitcoin chart all time, there are both ups and downs. For example, the answer to "How much is 2 Bitcoin" in 2019 was "25 thousand", which is six times lower than the current price. However, we remember the "first-time meme" and note that the record was also broken. This means that there is still an opportunity to invest in Bitcoin. For those looking to invest, it's essential to have a solid strategy, especially at these price levels.

New investors might consider dollar-cost averaging to mitigate risk, while experienced investors could explore taking profits at key resistance levels. Understanding market cycles and setting realistic goals is crucial to maximizing returns in the highly volatile crypto landscape. Remember that when choosing a strategy, you must understand what is Bitcoin trading at now and your short- and long-term investment portfolio.

Conclusion

Thanks to our article, you learned the answer to the question "$74000 a year is how much an hour" and the latest Bitcoin price news – we hope this information was useful for you. Bitcoins journey to $70,000 is a testament to the cryptocurrency's resilience and growing acceptance. While this milestone brings excitement, it also highlights the need for careful consideration, especially for new investors. Whether Bitcoin will continue its ascent or face new challenges remains to be seen, but its role in the financial landscape is undeniable.